One of the most important questions that comes into the mind of stock market investors, especially beginners, is how to read stock charts. Whether you are a trader or investor, you should know the basic chart reading, as this will help you make informed decisions while investing or trading in the stock market.

In this blog, let’s understand, in simple language, what stock charts are and how to read stock charts as beginners.

What is a Stock Chart?

A stock chart is a price chart that shows the performance of a particular company’s stock or an index over time. The vertical axis, or X-axis, represents the time frame (intra-day, daily, weekly, monthly, or annual), while the horizontal axis, or Y-axis, represents the stock price.Stock charts present additional pieces of information to fully understand how a specific stock is performing in the market.

Why Should You Know How to Read Stock Charts?

To invest in stock markets without knowing how to read stock charts is like cooking without a recipe.That is why it is very important to learn stock chart analysis. You should know to read stock charts to:

- Select the winning stocks when the moment is right.

- Be able to purchase them.

- Understand when to sell a stock.

- You should also be able to tell if a stock is in demand (being actively purchased) or being sold quickly.

- Examine stock price trends to see if they have been volatile, stable, or settled at specific price points.

Once you understand the basics of stock charts, you can open free Demat account, allowing you to implement your knowledge in real-world trading without any upfront costs.

Basic Elements of Reading Stock Charts

Let’s understand the essential elements that are present in most stock charts.

Stock Symbol and Exchange

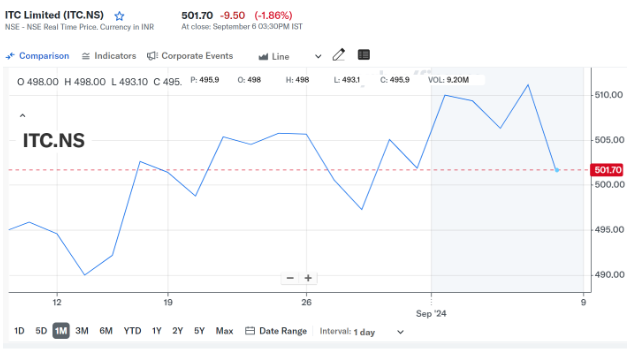

Every stock has a unique stock symbol, which is also called a ticker symbol. This is typically a combination of letters identifying the company on the stock exchange. For example, ITC represents India Tobacco Company Limited on the stock exchanges, as shown in the above image.

The exchange refers to the stock market where the stock is traded, such as NSE (National Stock Exchange) or BSE (Bombay Stock Exchange). While looking up a stock chart, it is important to know the exchange and the stock symbol.

Chart Period

The chart period shows how much data is represented on the chart. You can look at both long-term and short-term trends by changing the chart’s time period.For example, you can look at a chart for one day, week, month, or even year, as you can see in the above image.

Long-term investors would prefer to look at 1 or 5 years to get an overall picture of a stock’s performance. IIn contrast, day traders might find a shorter time frame of one day, one week, or so useful.

Time Interval

You must choose the interval at which the chart should be plotted. For example, if you choose the chart period as one day, then you need to decide if you want the data points to be plotted every minute, five minutes, ten minutes, 15 minutes, 30 minutes, one hour, or five hours.

Price

The stock chart will be plotted using price details for every interval as chosen. As a result, you will have four price points: the opening price, closing price, highest price, and lowest price of the stock.

This can be beneficial for traders because it provides information on the stock price fluctuations over a specified period at each interval.

Volume

Volume refers to the total number of shares that were traded during a specific time frame, such as a day. It’s typically displayed as bars at the bottom of the stock chart, as you see in the above image in green and red colours.

When the volume bar is green, it indicates that the stock closed higher during that period than it did at the close of the previous interval. When there is a red volume bar, it indicates that the stock closed lower during the current period than it did at the close of the previous interval.

Also, a high volume suggests that many investors are buying or selling the stock, which could indicate a strong interest in that stock. For instance, if a stock price is going up with a high volume, it might mean that there is strong buying interest, which could lead to further price increases.

Understand Three Main Types Of Stock Charts

Stock charts come in various stock market chart types, such as bar charts, candlestick charts, line charts, and many more, which serve different purposes for investors and traders.

Line Charts

Line charts are the most basic types of stock charts. They will help you understand how to read the price movement of the stock. These are created by connecting the closing price of a stock at a point in time (day, week, month) to the next closing price (next day, next week, next month), and so on. It generally provides users with a quick view of the overall trend of the stock.

For instance, if you are analysing a stock over a one-month time frame, a line chart will connect the closing prices of the stock each day with a line to show you the price movement of the stock over the past 30 days.

Bar Charts

Bar charts are far more valuable than line charts since they show all four data points: opening, high, low, and close.

The top of a bar shows the stock’s highest price at a particular point in time, and its bottom indicates the close. The left tick represents the opening price, and the right tick represents the stock’s closing price. Hence, if the left tick is above the right, it was a bearish day for the stock, as the opening price was higher than the closing price.

Also, the bar’s length represents the stock’s price range during the day. A longer bar is indicative of higher volatility and vice versa

Candlestick Charts

A candlestick figure is formed by plotting the opening, high, low, and closing prices of a specific time period on a candlestick chart. You will often come across candlestick charts when trying to understand how to read stock market charts. Candlestick charts give the same information as bar charts but with more visual detailing.

The wide portion of the candle figure is called the real body, which gives the stock trader the opening and closing price of the stock. And there is another part called the “wick,” which is above the real body and indicates the highest price reached, while the wick below it represents the lowest price during the same time frame.

Aside from basic chart types like line, bar, and candlestick charts, more advanced techniques like Elliott wave theory can help predict market trends. This theory is based on the idea that market prices move in predictable wave patterns, which can be particularly useful for technical analysts looking to identify trends and turning points in stock price movement.

Conclusion

When trading or investing in the stock market, knowing how to read stock charts can be quite helpful. Stock charts visually depict a stock’s price behaviour over time. This can provide you with a wealth of information that can assist you in making well-informed decisions on whether to buy, sell, or hold a particular stock. By learning at least basic chart-reading skills, you can recognise patterns in the stock market, identify trends, and time your entries and exits more effectively.

But it’s important to keep in mind that stock charts are only one instrument in an extensive toolbox of investing analysis tools. Even though they can offer insightful information, they should be utilised together with other analytical tools like news articles and financial data.

For a seamless trading experience, download the HDFC Sky trading app, one of the best trading apps in India with access to over 3500 listed companies. Now featuring TradingView Charts, the app for trading offers basic to advanced charting tools to help you make informed decisions.