Investing is pretty frightening and an activity that most people avoid, mainly because it is not an everyday activity. At least not because it’s the best means of starting investing in your money through a Systematic Investment Plan or SIP. But how will you know how much more your money will be after years or decades of investment.? That is where a sip calculator can help in bringing about the desired gradual change and in delivering the returns that are forecasted by such systems.

Definition of SIP Calculator

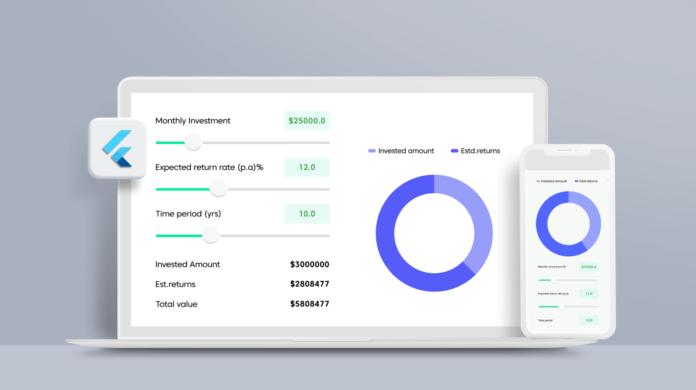

A SIP calculator is an easy-to-use and handy online tool that gives a picture of how much that investment may be worth in the future. It does this by incorporating several pieces of information, such as how much you would put into the investment every month and over what period, allowing the user to view possible revenues.

How to Use a SIP Calculator

Using an SIP calculator is pretty easy. Here is how to do it step-by-step:

- Insert Your Monthly Investment Amount: This is the amount through which you wish to contribute systematically.

- Duration of Investment: One is to decide the period for which one wants to continue investing.

- Input the Expected Return Rate: This is the figure of returns on your investment, assuming to be gotten every year. It could be 8%, 10%, or any other number depending on the performance of the specific mutual fund.

- View the Total Investment: The calculator will even tell you the total amount that has been invested over time.

- See Your Estimated Return: Last but not least, using the final SIP calculator, you would get to know about the sum of money that your investments would be able to generate by the end of the period selected by you.

Why Employ a SIP Calculator?

- Plan Better: By using a SIP calculator, one can get a glimpse of the financial aspect of their future. By inputting different amounts and periods, you can find out how much you would have at any particular time you have set your financial goal.

- Risk-Free Calculation: It is not at all difficult; you don’t need to do any sum in your head. That does all the work for you by using the SIP calculator.

- Set realistic goals: This tool makes it easier for an investor to know what is possible depending on the amount of capital used as well as the period of investment. I

SIP Return Calculator: An Essential Application for Investors

For anyone interested in investing in mutual funds through SIP, then using a SIP return calculator is mandatory. This calculator enables one to know how small a monthly investment can grow to be in the future. Better still, by changing the period and purchase frequency, you can bring your investments in line with certain financial goals.

Conclusion

For all new and old investors, using a SIP calculator proves to be useful in the investment process. Other indicators that can be used for assessing potential returns include the sip return calculator sbi, etc., which can be used for fine-tuning the investment plan. Other such brands are also available, like the 5paisa calculator, thus helping in making effective plans to invest.

Invest wisely, employ proper approaches, and create your financial protection to save money with constant, tiny contributions.